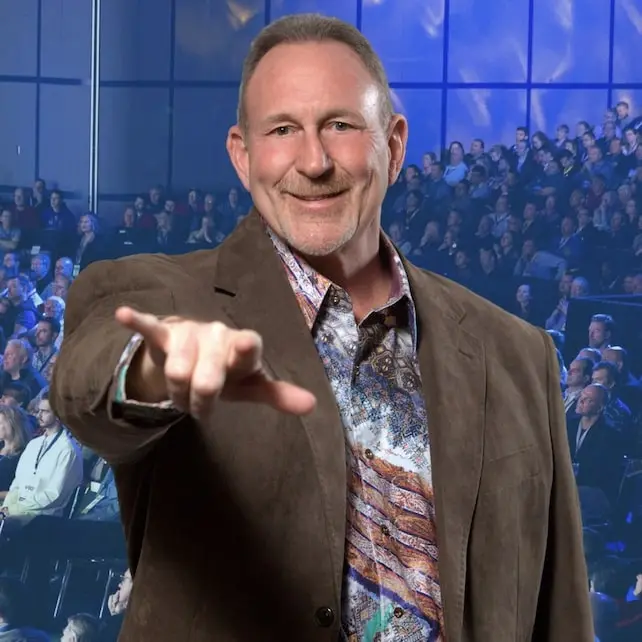

Del Walmsley knew one thing growing up: he didn’t wanna be a 200-pound fat kid.

So he started eating and training like a bodybuilder.

At 18, he opened his first health club. His goal at the time was to work himself to death.

He envisioned getting ahead and retiring at a young age. And he was on target to do just that, up until the market crashed and his portfolio plummeted.

Pretty devastating after having worked 12-hour days, six days a week, for 12 years to fund his nest egg.

So now what?

“I was irritated,” Del recalls. “I invested in a way I thought was wise; how they teach you to invest. And then it was gone.”

“And then I found one guy that talked about passive streams of income. And that really made sense to me,” Del continues.

“I didn’t want to just be a real estate investor. I wanted to retire.”

“But here’s the problem: retirement is not just a bundle of money. Retirement is a stream of income. That’s the misconception.”

“Everybody out there thinks if you pile a stack of money high enough that you can live off that pile until you die. Your goal is to die before you run out of money.”

“My definition is completely different than everybody else’s definition,” Del explains.

“I retired at 34 years of age, two and a half years after I started investing in real estate.”

“We have had hundreds if not thousands of people over the years that have reached the same level of retirement, which means simply this: we’ve replaced our earned income with passive income.”

“So we no longer need to get up and go to work to earn the same amount of money.”

“I didn’t want to just retire though, I wanted to be a millionaire.”

“A couple years later, I was a full-fledged millionaire,” Del brags.

“I didn’t want to just be a millionaire, I wanted to be one of the best investors out there and so I went out and became a competitive real estate investor.”

“In 2007, I won the National Apartment Association real estate investor of the year award.”

“The last thing I wanted to do is I wanted to be a self-help teacher. Not because I wanted another job, but because I wanted to be a teacher at something I’d already become successful at.”

“I didn’t wanna be a real estate seminar guru, I wanted to be a teacher.”

“So I went back on the radio and as of today you can listen to us on over 100 radio stations a week,” Del continues tooting his own horn.

“Then I went out and hired the best team I could find and said, ‘Hey, put together the best training program there is.'”

“It took us about a year and a half to do it but now we’re all over the country and we got events happening all over the country.”

“We show people how to use real estate to build wealth and passive income streams. We cover everything from single family homes all the way up to 600 unit apartment complexes.”

The only thing Lifestyles Unlimited doesn’t teach is house flipping.

Why? It’s too stressful. You have to find a house, get it at a great price, rehab it, hope that goes well, then hope some more that you can actually sell it at a profit.

But when you buy properties, hold them, and rent them out? It’s a more surefire way to grow your wealth.

And it doesn’t have to take decades for it to happen either.

“Your whole life you’ve heard you can’t get rich quick,” Del rants. “That is BS! You’ve just gotta focus on income. Making more money. Not learning to live on less.”

Lifestyles Unlimited offers free online and in-person workshops to teach you the basics.

From there, obviously, they try to upsell you into their premium programs.

These can cost anywhere from a few hundred to a few thousand bucks.

After that, there’s more intimate mentoring you can get for $20,000 and up.

Yes, it’s legit. No, Lifestyles Unlimited is not a pyramid scheme like some say.

But yeah, it’s a steep investment and then you’ll need capital (or at least good credit) to do deals once you learn the ropes.

Plus it’s super competitive these days.

I’m sticking to virtual real estate.